On his trip to China, German chancellor Olaf Scholz visited Bosch’s hydrogen drives plant. The facility illustrates there are still opportunities for German companies in future technologies in China

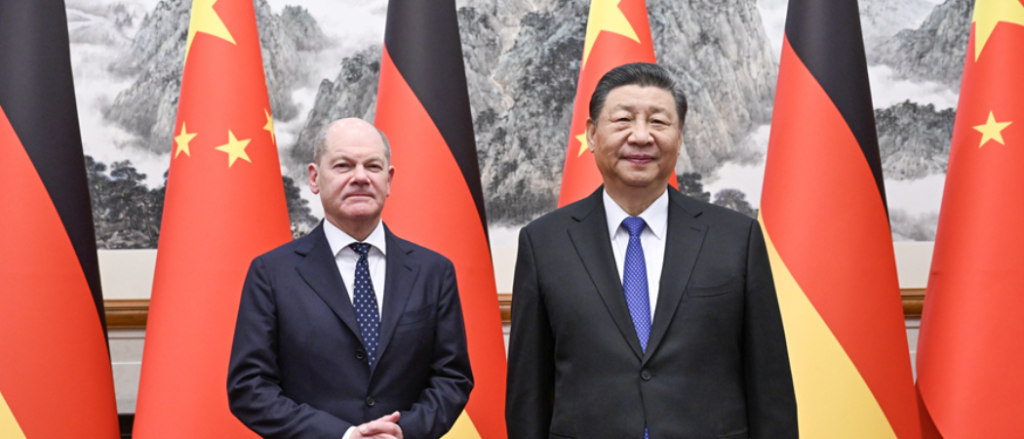

On the morning of April 16, German Chancellor Olaf Scholz (left) met with President Xi Jinping at the Diaoyutai State Guesthouse in Beijing. Photo credits: Embassy of the People’s Republic of China in the Kingdom of Cambodia

During his flight from Berlin to Chongqing earlier this week, German chancellor Olaf Scholz was informed of Iran’s attacks against Israel.

Nevertheless, he continued with his plan to visit the Yangtze metropolis after briefly commenting on the situation. The first stop on the chancellor’s three-day visit to China was Bosch Hydrogen Powertrain Systems in Chongqing, a joint venture of the automotive supplier, which manufactures hydrogen drives for commercial vehicles.

Initially, there were no details of the visit. However, the Bosch plant was carefully chosen as it exemplifies the opportunities that German companies still have in the cleantech sector in the People’s Republic, especially if they have cutting-edge technologies. At the same time, it shows the hosts what Germany still has to offer when it comes to future technology.

Bosch only began series production of its fuel cell drive system in Germany in July 2023 and ramped up production in Chongqing in parallel. The necessary components – fuel cell stack, air compressor with power electronics and a control unit with sensors – come from a plant in Wuxi in eastern China. “Bosch is the first company to produce these systems in both China and Germany,” said Stefan Hartung, chairman of the board of Robert Bosch at the time.

The hydrogen industry is still in its infancy worldwide – and its success in both heavy industry and parts of the transport sector, from aircraft to lorries, is crucial for a successful energy transition. China, which is entering the sector at a rapid pace, is aware of this.

While foreign companies such as Bosch are very active in the application of hydrogen and fuel cell technology – and in some cases also have access to project-related local funding – the production of the required hydrogen is in China’s hands. The key technology of the future hydrogen economy is electrolysis, which uses electricity to split water into hydrogen and oxygen. And after renewable energies and electric cars, electrolysis is another cleantech sector in which China is currently overtaking the west.

Installed capacity

According to a white paper published by the German Association for Electrical, Electronic & Information Technologies (VDE), “China currently leads in electrolysis.” At 610 megawatts (MW), more than half of the globally installed capacity is located in the People’s Republic. “With the rapid expansion of production capacities, Chinese manufacturers are creating cost advantages for the dynamically growing market,” the VDE study concludes.

Whoever gets big first will be the first to reduce unit costs – giving them an advantage over slower competitors. According to the VDE, global electrolysis capacity will increase 300-fold from around one gigawatt (GW) today to 305 GW by 2030. The International Energy Agency (IEA) even expects 3,500 GW by 2050.

This is rapid growth, but the energy transition requires the electricity needed for electrolysis to be generated from renewable energy sources in the medium term – only then will this produce so-called green hydrogen, which is the actual, renewable goal.

However, during the transition period, most hydrogen worldwide will still be produced using coal-fired electricity or electricity from natural gas – including in China. In a recent study, the Fraunhofer ISI expects that the People’s Republic, like the US, will be able to cover domestic demand for green hydrogen itself. This is thanks to the rapid expansion of huge renewable capacities.

In 2019, Germany and China signed an energy partnership that, according to the Federal Ministry for Economic Affairs and Climate Action (BMWK), includes green hydrogen as part of the bilateral dialogue. The focus here is “on the exchange on regulatory framework conditions and standards.” Germany has already set itself ambitious goals with its National Hydrogen Strategy, including market leadership in this emerging market.

However, regulations in China are still in the works. In March 2022, Beijing issued a long-term plan to develop a hydrogen industry by 2035. In August 2023, China issued the first guideline on standards on the hydrogen energy industry for producing, storing, transporting and using hydrogen.

China to build up, then decarbonise, the hydrogen sector

Experts believe that the ambition to decarbonise electrolysis – to make hydrogen green – has so far been lower at the national level in China than in other industrialised nations. The plans of individual regions, however, are much more ambitious in some cases.

According to a study by the state-owned Germany Trade & Invest (GTAI), Xinjiang, Inner Mongolia and China’s north-east (Dongbei) are regional development hubs for producing green hydrogen from wind and solar energy. These regions already have colossal wind and solar parks. Inner Mongolia is leading the way, with plans to produce 480,000 tons of green hydrogen annually by 2025.

However, a study by the Research Institute for Sustainability at the Helmholtz Centre in Potsdam found that sustainable hydrogen production is not a priority for the central government for the time being.

“China’s ambitions to promote hydrogen storage and transport remain at a relatively early stage of development with an important emphasis on the promotion of innovation and acquisition of technological know-how,” it says. As in other cleantech sectors, Beijing’s short-term priority is clearly to build a thriving industry – which will later also benefit the climate. This offers at least selective opportunities for companies such as Bosch in terms of application.

Photovoltaics and hydrogen are often in the same hands

However, expensive hydrogen production is often in the hands of large state-owned companies. According to GTAI, many wind and solar parks are operated by China’s state-controlled energy giants, some of which have now also become the leading manufacturers of electrolyzers.

One example is Sinopec, which commissioned what it claims is the world’s largest green hydrogen production plant in Xinjiang in the summer of 2023. The Xinjiang Kuqa Green Hydrogen pilot project uses its own photovoltaic systems the size of 900 football fields to produce 20,000 tons of green hydrogen annually through the electrolysis of water using solar energy, Sinopec announced.

Sinopec, which is actually an oil company, intends to use the plant to supply the hydrogen produced to a nearby refinery of its subsidiary Sinopec Tahe Petrochemical and replace the natural gas used there, according to reports.

This text appeared for the first time in Research.Table on April 14 2024, a professional briefing from the largest independent start-up for quality journalism in Germany. The editorial team reports for the key people in the research scene who set and fill the framework for science, research and development.